Thinking of moving the fresh new Suburbs? This Missed Federal Financial System Will save you Thousands

Home financing program originally designed to refresh rural communities might not become usually-utilized, nonetheless it yes does have the advantages. USDA finance – being mortgage loans guaranteed from the You Agencies regarding Agriculture – come with zero down payment, smaller financial insurance fees and you may low interest.

Nevertheless, the new USDA protected only 137,000 funds for the 2020. Which is upwards 38.9% compared to seasons earlier in the day, but USDA financing accounted for only 0.4% of all the financial pastime last week.

The fresh new minimal use can be a bit stunning because of the prevalent supply of these types of funds. Predicated on Sam Sexauer, chairman regarding home loan credit in the Locals Financial inside Columbia, Mo., from the 97% away from You.S. landmass is simply USDA-eligible. More than 100 million People in america inhabit qualified organizations – many discover 29 kilometers or faster external major metros.

It’s often thought that USDA funds are only for facilities or agricultural features, but that is incorrect, said Scott Fletcher, president out of chance and conformity during the Fairway Independent Financial, the big inventor from USDA mortgage loans in the united kingdom. USDA fund don’t need to getting getting a ranch or features a large acreage to be qualified.

From the it actually. Consumers can frequently use USDA loans on suburbs – an area of numerous keeps flocked as the pandemic first started prior to history season.

Having COVID ultimately causing a rush to your suburbs, USDA loans is actually a great financing to have funding a home, said Wayne Lacy, branch director and senior mortgage maker in the Cherry Creek Home loan during the DeWitt, Mich. They give a minimal blend of personal home loan insurance and off commission of the many financing choices, plus they make to invest in most reasonable.

Exactly what are USDA money?

USDA fund – often called outlying casing fund – try insured from the You.S. government, a whole lot more particularly the fresh USDA. The newest finance had been established in 1991 to grow and you may bring more rural communities, but a huge swath of the nation is largely qualified.

The fresh USDA’s concept of rural’ is significantly wide than many do assume, told you Ed Barry, Chief executive officer off Resource Lender for the Rockville, Md. Homebuyers commonly diving into the conclusion your neighborhoods or details these are generally provided commonly rural’ regarding the conventional feel, so they really dont even comprehend an excellent USDA loan will be an alternative.

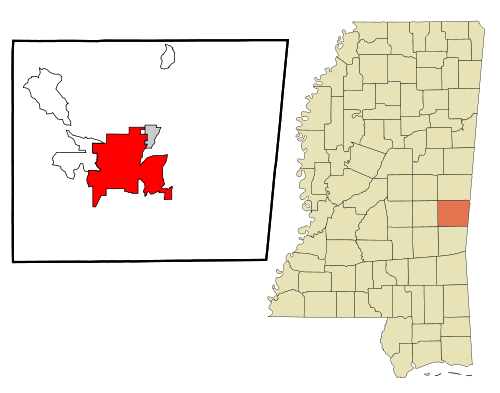

Buyers can be consider regional USDA supply when you go to the department’s possessions eligibility unit, plugging within the a speech, and you will seeing the latest USDA borders with the chart. In general, portion shady tangerine never qualify. These types of usually include large metropolitan areas and their denser, far more instant suburbs.

An example is the Houston metro. Regardless of if Houston proper is not qualified to receive USDA money, of several teams simply 31 miles out was. This can include locations instance Cleveland, Crosby and even parts of Katy – the top town paydayloanalabama.com/pine-level to have inward actions from inside the pandemic, centered on an analysis of USPS transform-of-target study.

As to why use an excellent USDA loan?

If you find yourself to buy when you look at the a USDA-eligible area, these low-pricing financing are worth believe. For one, they will not require a downpayment – and can mean huge offers right from the start.

The most significant brighten of USDA financing would be the fact there’s zero significance of a deposit, Sexauer said. Away from Virtual assistant financing, USDA financial support ‘s the simply 100% resource solution readily available. (Virtual assistant loans is actually arranged simply for productive army users, pros and their spouses, leading them to not available toward majority of homeowners. Still, the new Institution away from Experts Points secured an archive 1.dos mil lenders a year ago.)

To locate a concept of what an excellent USDA financing will save you your, consider antique financing – the most popular form of mortgage in the industry. At least, conventional funds need at the least a good step 3% deposit, otherwise $15,000 into the $250,000 family. FHA funds require a whole lot more – any where from step 3.5% in order to ten% based on your credit rating.