In the event that you Need A tsp Loan: 7 Crucial Issues Responded

As you browse through your personal loans excursion, the option of taking a loan from the Thrift Savings Package (TSP) get happen. When you are a tsp financing could offer a source of investment, it’s crucial to possess an extensive understanding of the process and you may effects before deciding. Within this post, we’re going to security 7 key concerns to help you generate a knowledgeable selection about a tsp financing.

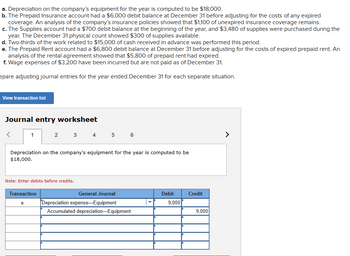

Create I Be eligible for a tsp Mortgage?

Being qualified getting a teaspoon mortgage is relatively easy. As your own bank, what’s needed was minimal. You need to be already doing work in the us government or army, has actually at the least $step 1,000 on your own Tsp membership from your contributions and you will relevant income, n’t have completely paid back a previous Teaspoon mortgage in the last a month, while having zero disappointed judge instructions facing your bank account. The good thing? There are no borrowing from the bank monitors, and you will borrowing from the bank wouldn’t affect your credit rating.

Just what are My Financing Possibilities?

There are 2 form of Tsp loans: general-purpose fund and top residence money. General purpose funds are used for one you prefer as opposed to paperwork and its installment months is one able to five years. At the same time, primary household money is actually strictly for choosing otherwise strengthening your primary home and its particular installment several months was 5 so you’re able to fifteen years. Records demonstrating the purchase will cost you or framework will cost you of one’s this new family need to be registered contained in this 1 month of your own financing consult.

You could have only two fund simultaneously. One can possibly getting a standard mission loan as well as the most other good first residence loan, you can also provides one or two general-purpose fund on the other hand. not, you can not provides one or two prie big date. When you yourself have both a civil and you will an army membership, these types of limitations pertain alone to each and every Tsp account.

Just how much Must i Use?

You can only borrow funds that’s invested in this new TSP’s center finance and you will lifecycle finance. The minimum you might acquire try $step one,000, to the limit capped within $50,000 or reduced, based the benefits and income. Brand new lent number is distributed proportionally from your own old-fashioned and Roth balance regarding the Tsp account.

Which are the Rates and you will Costs installment loans in Riverside WA with bad credit?

Tsp loans element seemingly reasonable will set you back, that have interest rates associated with the fresh G Fund’s price from get back. The rate of interest will stay repaired towards the longevity of new financing. You’ll find limited charge regarding $fifty getting general-purpose finance and you may $100 to have number 1 residence loans. This type of charge try deducted directly from the mortgage matter. Just like the lead prices are lowest, it is in addition crucial to look at the secondary costs away from possible shed capital gains on borrowed number.

How ‘s the Tsp Loan Repaid?

Teaspoon loans is repaid using payroll write-offs, guaranteeing a hassle-free processes. You can build additional costs to clear the borrowed funds reduced, without charges to have early fees. Contemplate, if you key services or log off work, you ought to perform financing costs consequently to quit taxation effects.

How do i Apply for a tsp Loan?

Applying for a teaspoon mortgage is convenient through the online webpage. Spousal agree will become necessary to have partnered someone, but repayment continues to be the borrower’s obligations. Just after acknowledged, loans are typically paid in this three working days thru direct deposit.

Ought i Borrow funds out of My personal Teaspoon?

Choosing whether to get a teaspoon loan was a personal selection. When you have other currency available for your circumstances, it’s wise to fool around with one basic to get rid of impacting pension coupons. If you have pretty good borrowing from the bank, want reasonable rates, and can pay-off the loan, a tsp loan might work to you. Envision just how secure your task try as well as how a lot of time you intend in which to stay the us government otherwise army prior to credit. Making which have a fantastic loan may lead to large taxes.

Develop you enjoyed this blog post. If you have any queries or issues about federal professionals otherwise retirement think, connect with us. Here’s a few away from ways we are able to assist:

- Publication a free of charge forty five-minute visit having a good Fedway Monetary Mentor.

- Subscribe to our very own YouTube Station The bucks Briefing to track down informative posts in the government advantages and you can retirement planning.

Jerel Harvey

Jerel Harvey ‘s the Founder and you may Controlling Dominant regarding Fedway Monetary, an advisory company giving monetary thought, capital administration, and masters training for the federal workforce.