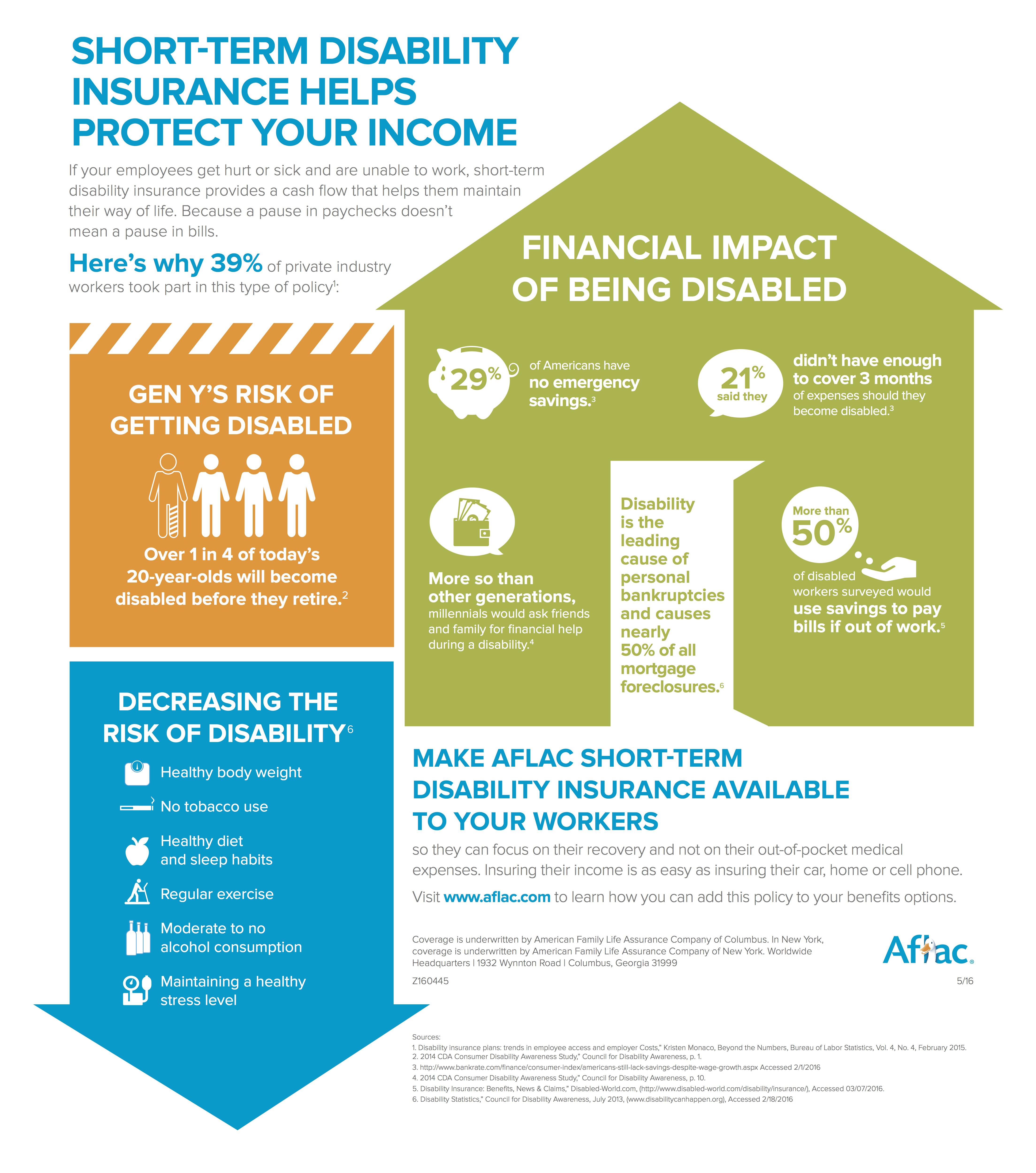

These publicity is known as “force-placed insurance policies” otherwise “lender-put insurance coverage

- ranging from 210 and 240 days (eight to 8 days) months prior to the very first fee due following the speed earliest adjusts, and you may

- ranging from 60 and you will 120 months (two to four months) in advance of payment from the an alternate level flow from when a speeds variations factors a payment transform. (a dozen C.F.Roentgen. ).

- Palms having regards to one year otherwise reduced. Brand new collector or servicer doesn’t have to transmit an alerts when the interest rate initially or subsequently changes whether your changeable-speed mortgage enjoys a phrase of one year or quicker.

- The original adjusted payment is in 210 months once consummation from the loan. A speeds variations find is not required in the event the basic payment within modified height is due within 210 days immediately following consummation of mortgage additionally the collector unveiled the fresh new rate of interest at the consummation. (“Consummation” occurs when you feel contractually compelled to your financing.)

- You send out good give it up communication observe with the servicer. If for example the servicer was at the mercy of new Reasonable Commercial loan places Grove Hill collection agency Means Act (FDCPA), therefore post an authored notice into servicer to eliminate communication along with you, it will not must upload constant notices regarding price improvements. (They nevertheless need to post a notification concerning the 1st interest modifications.)

Timely Borrowing from the bank Mortgage payments

More often than not, servicers need timely borrowing from the bank a debtor to your complete payment the date it is acquired. (several C.F.R. ).

If your debtor merely helps make a limited commission, you to amount could be kept for the an alternate account (entitled good “anticipation account”), although servicer need certainly to update the fresh debtor with the monthly statement. Since suspense account has actually adequate fund and work out a complete commission out of prominent, appeal, and you will one escrow, the servicer need certainly to borrowing one to payment on the account. (12 C.F.Roentgen. , 12 C.F.Roentgen. ).

Work Easily in order to Incentives Desires

The fresh servicer basically should provide an accurate benefits balance to help you a beneficial debtor zero after than simply eight business days after getting a created consult asking how much it will cost to pay off the financial. (a dozen C.F.R. ). On occasion, the fresh new servicer should provide the new declaration contained in this a “practical time.”

On this page, you can find details on government financial regulations, which have citations in order to laws to learn more. Rules alter, so examining all of them is a good idea. Exactly how process of law and you can firms translate thereby applying what the law states also can change. And some guidelines may even are different in this your state. These are simply some of the reasons why you should thought consulting a keen lawyer.

Provide Options to Prevent Push-Placed Insurance coverage

Mortgage loans need home owners for sufficient homeowners’ insurance toward property to safeguard the brand new lender’s need for matter of flame or any other casualty. In the event the a borrower lets the insurance coverage lapse, the newest servicer can obtain exposure and you may are the pricing to the mortgage percentage. (a dozen C.F.R. ). “

- need publish find at the very least 45 months earlier requests a force-set insurance coverage, which provides individuals plenty of time to acquire their unique rules

- need posting notice again at the least thirty day period later on-as well as least 15 days just before asking the brand new debtor having push-placed insurance policies-if the servicer has not yet acquired facts regarding debtor one to insurance policies might have been bought, and you will

- essentially need certainly to keep the current insurance coverage if there’s an escrow account where new servicer will pay the insurance coverage costs, even if the servicer needs to get better financing for the borrower’s escrow membership to accomplish this. The brand new servicer can then incorporate which cost on the escrow balance if not search compensation on the debtor for the funds state-of-the-art.