An easy Note into Individual Mortgage Insurance

CHFA in addition to necessitates that you are taking property customer training category. Kinds are available online and for the-person. CHFA suggests bringing the classification early during your domestic look so that you are willing to to get a lender and you will a residential property broker who happen to be an informed fit for your.

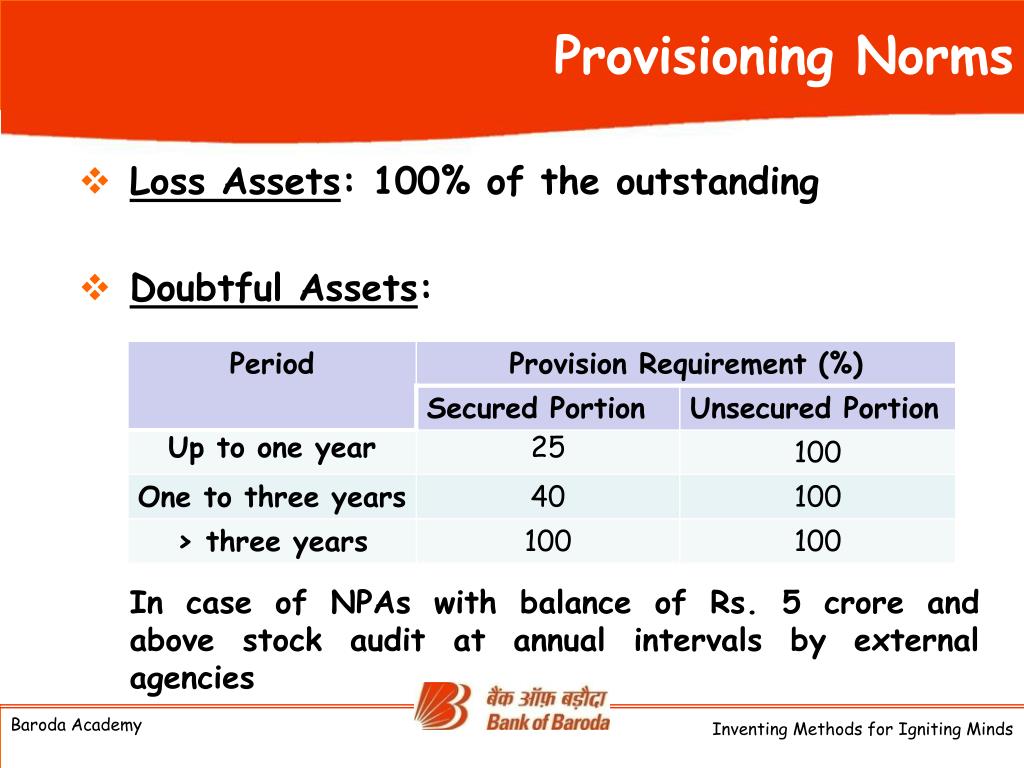

Since we discussed, particular software keeps low down commission standards to own first-time house buyers. But the majority of of those applications incorporate an extra month-to-month rates named private mortgage insurance rates (PMI). PMI is basically an agenda you have to get (at your own bills) that covers the financial institution in the event you end up defaulting into the their home loan.

PMI is usually required by the financial institution for folks who set faster than simply a 20% deposit on your own home. The price of PMI is commonly ranging from 0.5% and you will step one% of full amount borrowed. So it adds up to $1,000 a-year for every single $100,000 lent. Put simply, while taking out fully a beneficial $two hundred,000 home loan, you’ll be able to are obligated to pay an additional $166 payment to have PMI.

The fresh new Government Homeowners Shelter Work offers the ability to ask a lender to eradicate PMI once you’ve at the least 20% home security. This simply means you possess 20% of your property possibly once the you paid that much, or due to the fact business works in your favor and you may increases the overall value of your residence.

Federal Apps to possess Basic-Big date Homebuyers

Federal mortgage programs promote an alternative choice to possess first-time homebuyers in the Tx. Like, when you’re incapable of meet with the borrowing standards of your own local county software, a national system may possibly provide more flexibility. Check out choices which might be appealing to first time home buyers because they take on reasonable credit scores and provide off commission guidelines.

FHA loan: A keen FHA financing is a good alternative if you have an effective lower credit history. A credit history off 580 or even more may will let you set out just step three% on the a house buy. A credit history lower than 580 need a great 10% deposit.

Va fund: Virtual assistant financing are glamorous because they do not require a down-payment, and you may credit rating conditions try flexible. You should be active in the army, a veteran, otherwise a being qualified partner to make use of this option. At exactly the same time, zero PMI is required for it system.

USDA finance: USDA funds are available to accredited borrowers buying in some geographical portion. This generally speaking boasts outlying portion that have populations of less than 20,000. There is absolutely no down payment needs, however the borrower demands a credit rating out of 640 or more.

Carrying out a stronger Financial Future

Due to the fact a first time home buyer in the Texas, you have access to unique programs you to most other customers can’t access. is useful to suit your disease is actually an individual alternatives, nonetheless it starts with inquiring a few pre-determined questions: What kind of cash could you be able to lay out to your house pick? What exactly is your credit score? Just how much could you afford to spend each month?

We know the facts can seem to be overwhelming, but the search you may be starting today is the perfect basic step! The greater you are sure that regarding the solutions and also the best you realize their to invest in strength and you can limitations the better updates you are directly into lock down your ideal family.

Extremely lenders have fun with a personal debt-to-money proportion and do not along these lines proportion so you’re able to exceed 43%, according to the program. Such, let’s say which you bring in a terrible paycheck away from $4,000 month-to-month (extent just before taxes or write-offs is applied for). Your full number of personal debt, including the home loan, mastercard repayments, and you will vehicles repayments are $step one,750. Separate your debt from the earnings while score a DTI proportion regarding 43%. In this situation, in the event your financial obligation happens people large, you are going to have trouble being qualified to the CHFA system.