Providing a mortgage loan Which have 0 % Off

Otherwise to possess off money, even more people might possibly be property owners. The fresh new downpayment was a barrier you to definitely deters them off even trying to buy a property. Even with a fair money, it’s no simple feat to build up 20% of a beneficial home’s cost. The new delighted development is that you don’t need to come up with a sizeable down-payment. Numerous apps offer in order to 100% financing. So you might become to get one basic house sooner than you consider.

A mortgage that allows basic-big date people to find property without having any up-top money, except for plain old settlement costs, is a zero downpayment home loan. You don’t have for a buyer to blow an effective 20% down-payment in today’s construction elizabeth a myth towards the first FHA (Federal Housing Management) finance created in 1934. Only with the typical loan is an effective 20% down-payment had a need to prevent spending PMI (personal financial insurance coverage).

USDA Funds (100% Financing)

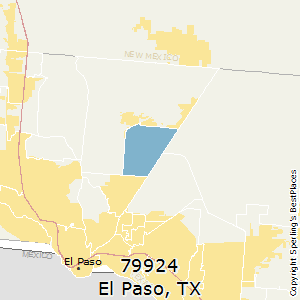

Officially also known as a rural Housing Loan, the newest You.S. Service away from Agriculture (USDA) provides no-deposit mortgage loans. So it financing can be found to possible reasonable so you can modest-money customers that will inhabit the home located in a keen qualified urban area. The main focus of one’s USDA Unmarried Family relations Housing Secured Financing System is actually for rural development also to bring family members that have potential to have ownership out of secure, hygienic, and you will decent dwellings. Specific popular features of so it mortgage are:

- You can add the expense of qualified repairs and you may developments with the loan amount.

- This is simply not limited by very first-date property owners.

- The dwelling have to be for the an eligible outlying town.

- Accessible to those who do not get a conventional loan with out to expend PMI.

If not qualify for which mortgage, the newest USDA has a direct 502 get program where it can also be subsidize the mortgage payments, as long as you you should never earn more than just 80% of one’s MHI (average household earnings).

Virtual assistant Fund (100% Financing)

This new no deposit Va loan exists in order to people in the newest You.S army (active obligation and honorably discharged) and their partners. The borrowed funds can be extracted from individual loan providers and you will protected from the the newest U.S. Department away from Experienced Affairs, or it may be a good Virtual assistant direct loan where Va is the lending company. Finance are offered for manager-renter home and land as filled from the eligible partner otherwise oriented (to possess active responsibility services players). Options that come with that it mortgage is actually:

- You are able to use to construct, get, otherwise boost a home.

- No downpayment is required provided the newest price point is not above the appraised value.

- No need to own PMI or MIP (home loan insurance costs)

- Less closing costs.

- Zero penalty for folks who spend the money for financial from very early.

Another fund require an advance payment, but it is somewhat smaller compared to 20% of purchase price. If not be eligible for a no-put financing, you happen to be entitled to among the following.

The HomeReady Mortgage (3% Down)

The fresh new HomeReady Financial are backed by Federal national mortgage association that is available out-of every You.S. centered bank. That it financial supplies the household buyer lowest home loan prices, quicker home loan insurance coverage, and creative underwriting. The income of everyone living in your house represents whenever determining qualification and you can acceptance to your home loan. You can fool around with boarder earnings otherwise a non-zoned local rental unit (regardless if you will be paid in bucks) in order to be considered. So it financing was designed to score multi-generational house running their dwellings by offering financial funding in just a good step three% down payment. But the system can also be used from the loans Candlewood Shores somebody during the a keen qualified town who matches the family money demands. Are you searching for a creative choice to your property-to find condition? We could help you with your own home loan, to help you waste time trying to find your dream domestic. Telephone call Mares Home loan today!