Please note, at the time of creating, the average interest rate having a home loan is actually hovering to 7%

When it comes to to get an additional domestic, one of the most important factors knowing ‘s the attract price you’ll end up purchasing on your mortgage. Interest rates getting second residential property, which happen to be functions you want to occupy and their first household getting a portion of the seasons or even for financing intentions, are typically greater than those individuals to possess number one homes, given that lenders take a look at all of them because riskier investment.

In this post, we will dive on current state of great interest rates getting 2nd residential property, the standards you to dictate these rates, and you may what you need to see before you buy one minute property.

However, so it speed are at the mercy of changes and you’ll be calculated considering a great amount of facts together with your credit rating, the mortgage-to-worth proportion, and the precise location of the assets.

What matters since the the second Family?

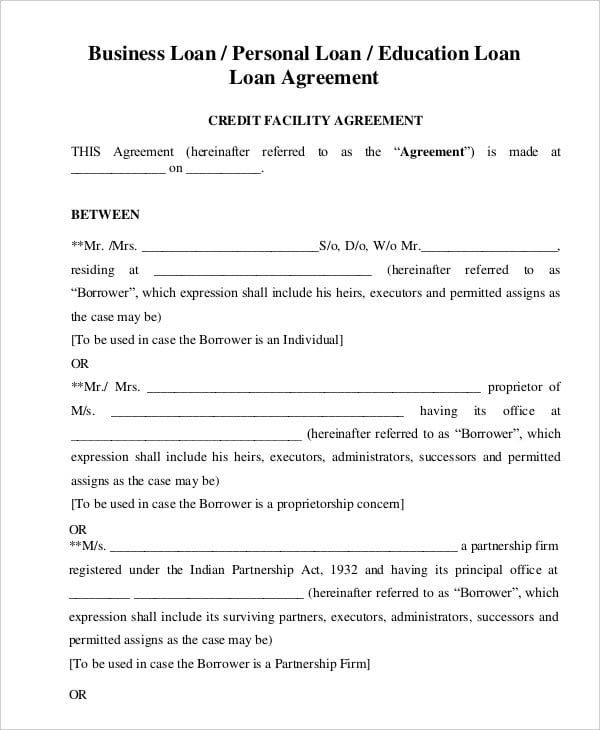

![]()

The next home, commonly known as a holiday house, is a property you possess other than much of your house. Its a home where you invest the main seasons, identifying they from your chief lifestyle home. The borrowed funds gotten to invest in this purchase is named an additional home loan.

Investigation in the Federal Organization from Home Developers found there had been eight.15 billion second homes on U.S. for the 2020, making-up 5.11% of the overall housing inventory. Since that time, for example determined by the new pandemic, there has been a serious increase in travel family purchases from inside the the second 1 / 2 of 2020 and you can into the very early 2021, reflecting click here now a move for the lifetime and functions figure.

- It must be a single-family home.

- It needs to be habitable all year round, not merely having regular occupancy.

- You may be anticipated to reside around getting a specific months a year.

- The new possession need give you personal control over the house or property, and therefore excludes timeshares or attributes in handling of possessions government enterprises.

- The house or property can not be hired aside full-day, nor is it possible you rely on local rental money so you’re able to service the loan.

These criteria ensure that the property really functions as a personal retreat in place of a rental money, identifying second property on monetary surroundings.

Funding Household versus. Next Home

An investment property makes you mention the realm of actual estate financial support, targeting a lot of time-identity monetary progress through leasing money. Rather than an extra household, an investment property is not a location the place you create generally invest getaways or alive region-time; it’s purely to have income generation or capital appreciation.

In case the mission that have a home is always to earn local rental earnings, loan providers usually classify it as a residential property, affecting the mortgage conditions. Funding attributes often demand a more impressive advance payment than next belongings because of the perceived greater risk by lenders.

For this reason, when you’re deliberating anywhere between to find your own sanctuary otherwise and come up with an enthusiastic financing, an investment property merchandise a path to cover both expectations, marrying the very thought of a residential property control with financing.

First Quarters

Your primary house is more than just an address; its in which your daily life unfolds for the majority the season. They really stands compared to funding features, as it functions as your very own living space rather than a good source of local rental income. The newest emotional property value an initial house tend to is better than the money potential.

Although not, whenever you are considering transitioning the majority of your home to the a residential property so you’re able to utilize prospective local rental money, it’s required to browse this move cautiously. This includes obtaining concur from your own mortgage lender to prevent violating the new regards to the loan and you will seeing a taxation mentor to know the latest effects, for example possible changes in the tax liabilities and you can benefits. This planning ensures you are better-advised about the financial and you may legal aspects of these a transformation, safeguarding your hobbies and you may optimizing your property’s worth.